20s is the most important phase of your life . If you are thinking now, How to start investing in your 20s. if you are at 20s, that mean you are jus completed your education or statrted your working profession. If you will start investing in your 20s then you have sufficient time grow your capital through compounding .

Table of Contents

Top 3 Reasons why you should start investing at your 20s

1. Investing from age of 20 increase the chances having a huge corps by the age of retirement.

Investing from the 20s significantly increases the chances of your wealth by retirement due to the power of compound interest. Starting early allows your investments more time to grow, as returns on your initial investments generate further returns over time. Overall after several decades , even your small amount of investment can grow into a large portfolio by your retirement time.

2. Early investing gives you the benefit of Risk averaging.

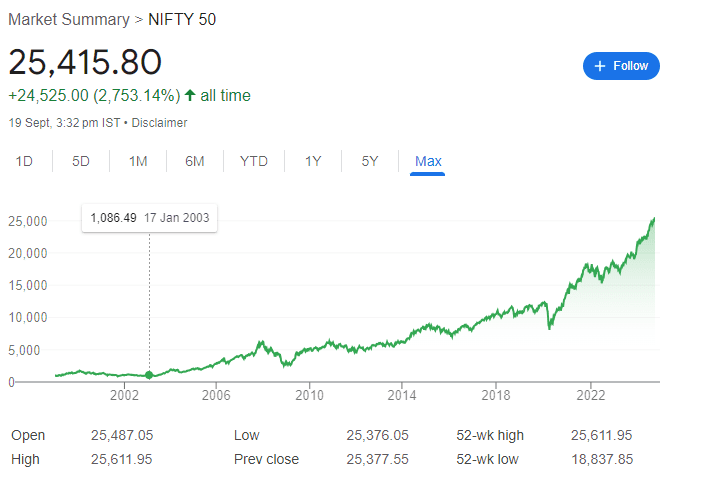

Becouse you have started investing early it gives you the benefit nof Risk averaging. Have a look at the Chart of Nifty 50 . Let assume a person X satrted investing in 2008 and after his sarting market crashed due to lehman brother cricesh if Mr X do not stop investing an continue to his investment and you can market level with which where mr X had been started investing . you can clearly see the markeyts ups and downs which can averge your Risks.

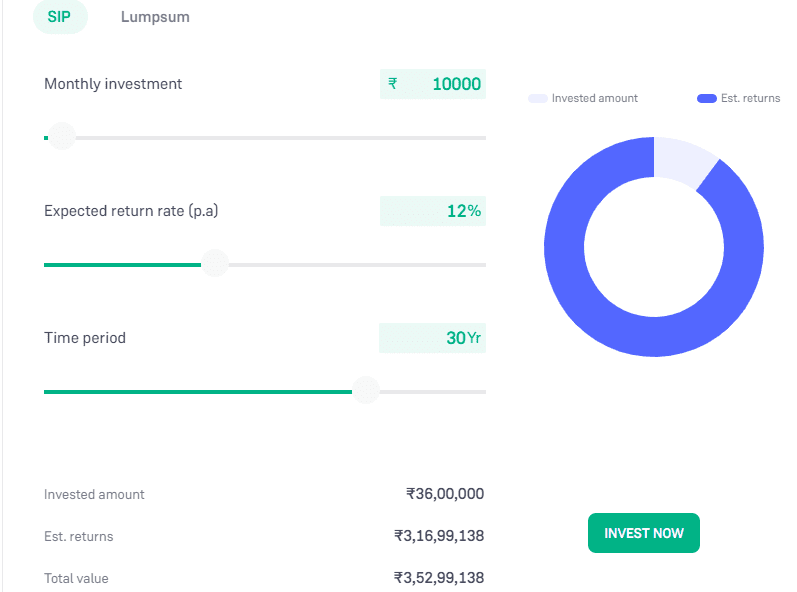

3.Higher returns on long term investments because of compounding effect.

Lets understand how and amazing returns of your investment because of compounding effect.

Investment Calculator – You can use groww SIP Calculator

Top 3 things young investors should avoid while investing

1. Blindly following the investment tips

If you are thinking now, How to start investing in your 20s. Don’t Invest based on tips of your freinds or relatives. If you are investing because of your freinds so please don’t do this.

2.Jumping in the market without prior knowledge

The most done common mistake by the the young investors is jumping in the market without prior knowledge of investing. This should avoid at the starting of investing. If you are thinking now, How to start investing in your 20s.

3. Please Do not follow the Herd mentality

Do not invest based on herd mentality. Instead, make your investment decisions based on thorough research and analysis. Just because many people are buying or selling a particular stock or asset doesn’t mean it’s the right move for you. Following the crowd can lead to poor outcomes, as market trends driven by emotions are often unpredictable. It’s important to stay focused on your financial goals, risk tolerance, and long-term strategy, rather than simply mimicking what others are doing.

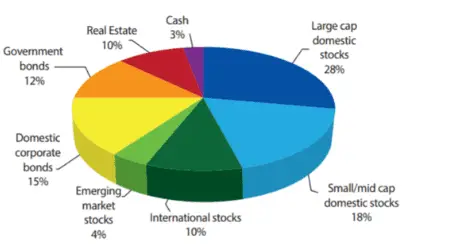

How to diversify your investment

Here is the solution how to diversify investment ? Basically subtract your age from 100 should be the percentage which you have to invest in equity and rest in debt market. If you are thinking now, How to start investing in your 20s.

Invest in Equity

Stock SIPs – :

If you are thinking now, How to start investing in your 20s. Stock SIPs ( Systematic Investment Plans ) allow investors to invest a fixed amount of money in individual stocks at regular intervals, such as monthly or quarterly. This method helps spread out investment risk by averaging the purchase price over time, rather tha n trying to time the market. Stock SIPs are similar to mutual fund SIPs, but instead of investing in a basket of securities, you invest in specific stocks. It’s a disciplined way to build wealth gradually and take advantage of the power of compounding .

SIPs Theme -:

SIPs (Systematic Investment Plans) with a Theme allow investors to focus their investments on specific sectors, industries , or market trends. In a thematic SIP, the money is invested in funds or stocks that align with a particular theme , such as technology, renewable energy, healthcare, or ESG (environmental, social, governance ) initiatives. Thematic SIPs help diversify you r portfolio within a particular area of interest or market trends .

Nifty BeES -:

Nifty BeeS (Benchmark Exchange Traded Scheme) i s an exchange-traded fund (ETF) that tracks the performance of the Nifty 50 Index, which consists of the top 50 companies listed on the National Stock Exchange (NSE) of India. Since it’s an ETF, Nifty BeES is traded on the stock exchange, and its price fluctuates throughout the day like a stock. It’s a low-cost, passive investment option for thos e looking to gain exposure to the Nifty 50 indexs .

Debt Investing

Public Provident Fund (PPF)-:

PPF ( Public Provident Fund ) is a long term savings scheme backed by the Indian government, offering a safe and tax saving investment option. it has a 15-year lock-in period, and the interest earned is compounded annually. ppf contributions are eligible for tax deductions, and both the interest earned and the maturity amount are tax-free. It is a low-risk option for building a retirement corpus or saving for future financial goal .

Gold/Debt Funds-:

- Hedge against volatility

- Never put all eggs in one Basket

- possibilities of earning more than 7.1%

Portfolio Allocation-:

Pingback: What is a Mutual Fund and How does it work? | How to..

Pingback: How to Invest in SIP in 2024: Best Path to Financial Success